Corporate Attorney Test

Assess a Corporate Attorney's expertise in navigating legal complexities within business operations.

Evaluate tax accounting candidates with our scenario-based, conversational-style test.

Try for freeOur Tax Accountant test is meticulously designed to assess candidates on a spectrum of skills necessary for the role. It dives deep into their understanding of tax codes and their ability to apply tax laws in professional settings. The question format is a mix of multiple-choice, simulation, and open-ended questions, all set within real-world scenarios. For example, a candidate might be presented with a complex financial situation and asked to identify the best tax-saving strategies while ensuring compliance. Another scenario could involve using a popular tax software to prepare a return, testing not only their technical know-how but also their attention to detail and ethics in handling sensitive information.

The test scenarios are crafted to mirror the challenges a tax accountant faces daily. From navigating the intricacies of tax legislation to offering sound financial advice, candidates must demonstrate a robust analytical mindset. Through these scenarios, employers can witness firsthand how potential hires might perform in the role, providing a clear picture of their problem-solving approach and communication skills.

By simulating these real-life situations, we ensure that the test is not just an academic exercise but a practical demonstration of a candidate's capabilities. It's one thing to know the tax law; it's another to apply it effectively under pressure. Our test provides a comprehensive evaluation of both knowledge and application, giving employers confidence in their hiring decisions.

In an era where precision and compliance are non-negotiable, our Tax Accountant test stands as a pivotal tool in the HR tech landscape. It's rapidly gaining traction among industry leaders for its innovative approach to evaluating candidates' practical skills. This test is not just an assessment; it's an essential instrument for modern HR professionals committed to making informed hiring decisions in the accounting sector.

The benefits of utilizing our Tax Accountant test in your recruitment process are manifold. By offering a realistic and interactive assessment experience, it significantly enhances the hiring process's efficiency. This test allows for a more nuanced evaluation than traditional assessments, which often fail to capture a candidate's practical skills and critical thinking. Moreover, it's a cost-effective solution, reducing the likelihood of a mis-hire by providing a thorough understanding of a candidate's abilities before they join your team.

In addition to cost savings, our test streamlines the hiring process. Instead of sifting through piles of resumes and conducting numerous interviews, employers can quickly identify top talent based on their performance in real-world scenarios. This not only saves time but also ensures a more objective selection process. Furthermore, the test's design to simulate actual job tasks means that candidates are evaluated on the skills that matter most, leading to better job fit and retention rates.

Beyond these practical advantages, our test also offers an edge over traditional methods by incorporating a conversational style and scenario-based questions. These elements make the test more engaging for candidates, which can improve their performance and provide a more accurate reflection of their potential. By adopting this innovative assessment tool, employers position themselves as forward-thinking organizations, which can be attractive to top talent seeking a modern and dynamic workplace.

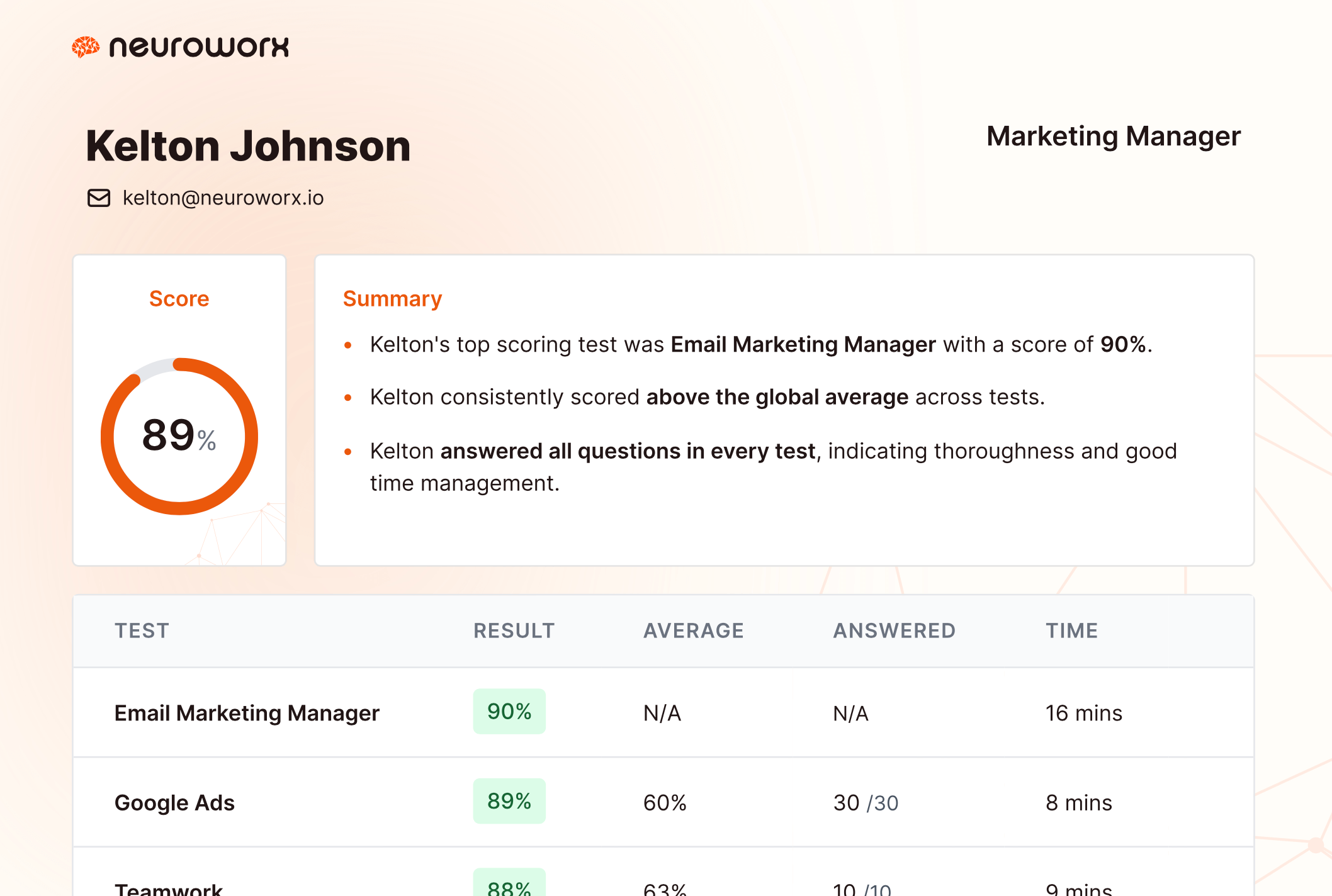

Results for the Tax Accountant Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

The methodology behind our Tax Accountant test is rooted in a deep understanding of the role's requirements and the skills necessary to excel. Each question is designed to not only test knowledge but to also evaluate the application of that knowledge in a practical context. Our comparative scoring system then benchmarks each candidate's performance against industry standards, ensuring a fair and accurate assessment.

The test's questions are regularly reviewed and updated by experts in the field to reflect the latest tax laws and software advancements. This ensures that the test remains relevant and effective in identifying candidates who are truly up-to-date with their knowledge and skills. The adaptive nature of the test also means that it is suitable for candidates at different levels of expertise, adjusting the difficulty of questions based on the candidate's responses.

Our commitment to developing and refining the Tax Accountant test is unwavering. We continuously gather feedback and data to improve the test's accuracy and relevance. As the tax landscape evolves, so does our assessment, guaranteeing that employers always have access to a state-of-the-art tool for evaluating job candidates. With this test, employers can be confident that they are measuring the skills that will truly impact their organization's success.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

Absolutely, our Tax Accountant test is designed to accommodate candidates at all levels of expertise. It features an adaptive difficulty scoring system, which tailors the test's complexity based on the candidate's responses, ensuring a fair and challenging experience for everyone.

The test covers a broad range of topics, including understanding and applying tax codes, laws, and regulations; preparing accurate tax returns; strategic financial decision-making; offering tax advice; identifying tax-saving opportunities; and ensuring compliance with current tax legislation. It also evaluates candidates' proficiency with tax software and their ethical judgment.

Our test is built on cutting-edge technology that dynamically refines and updates its questions, ensuring that the assessment stays current with industry standards. This continual refinement process guarantees an unparalleled level of accuracy and relevance in evaluating candidates.

Candidates can take the test through a secure, user-friendly platform, accessed via a unique invite link. We prioritize a straightforward test-taking experience while upholding the highest standards of security and integrity with robust anti-cheating measures.

After completion, each candidate receives a detailed report outlining their strengths and weaknesses. The report also includes a comparison against industry benchmarks, providing valuable insights to help employers make informed hiring decisions.

Assess a Corporate Attorney's expertise in navigating legal complexities within business operations.

Assess Project Engineer candidates' problem-solving and project management skills with our scenario-based test.

Assess HR Director candidates with a scenario-based exam focusing on critical soft skills and leadership abilities.

Data entry clerk tests are designed to help employers identify candidates who possess the highest aptitude required to carry out this role with precision.

Talk is cheap. We offer a 14-day free trial so you can see our platform for yourselves.

Try for free