Medical Transcriptionist Test

A medical transcriptionist test helps prospective employers identify which candidates have the necessary skills and competencies to be an effective medical transcriptionist.

A credit analyst test is an assessment of an individual's skills as relevant to those required to be an effective credit analyst.

Try for freeCredit analysts work on behalf of loan or credit organizations, assessing whether an individual’s application for credit should be approved.

Credit analysts use a variety of information when making their decision, such as a client’s financial situation, financial history, and economic data. Their role requires them to have a high level of numeracy, logical reasoning, problem solving and communication skills.

The credit analyst test evaluates individuals on whether they have this skill set and their level of proficiency in these skills. The test is a series of timed multiple-choice questions, the results of which can be used to determine which candidates in an applicant pool are the most qualified skills-wise for a credit analyst position.

When used in the early stages of the recruitment process, the credit analyst test is a cost-effective way to identify the best candidates for the jobs you have to fill, ensuring you make successful hiring decisions.

The credit analyst test is a pre-employment screening tool used to determine whether individuals have the skills needed to be effective credit analysts.

Credit analysts are an integral part of an organization's lending team. They make decisions on whether an individual’s loan application should be approved, basing their decision on source information such as an individual’s payment history, financial standing and credit score.

The credit analyst test evaluates individuals on the skills needed for the role. The skills evaluated include analytical skills, their ability to work with financial information, and their communication and logical reasoning skills.

Credit analysts work as part of a financial organization's lending team. Their role focuses on determining the creditworthiness of an individual applying for a loan. Their role calls for strong IT, numeracy and analytical skills, all skills that are challenging to assess from a CV or interview alone.

When recruiting for credit analysts as an employer, you want to ensure you make the right hiring decision. Determining which applicants in your applicant pool are proficient in the skills needed for a credit analyst, especially when candidates have similar experience levels, can be tricky.

The credit analyst test allows recruiters to evaluate candidates objectively on their skills. The comparative data from the test can be used to identify which candidates demonstrate the skills needed to be effective in the role.

Candidates who attain a high score on the test are likely to be successful credit analysts proficient in analyzing numerical data and making logical lending decisions based on this. Those that attain a score that falls below the required benchmark can be eliminated from the process.

When used as a pre-screening tool, the credit analyst test is a practical and bias-free way to shortlist the best candidates for the credit analyst positions you have to fill.

As the skills needed to be a credit analyst are shared by many other roles, the credit analyst test is a beneficial recruitment tool when hiring for roles such as:

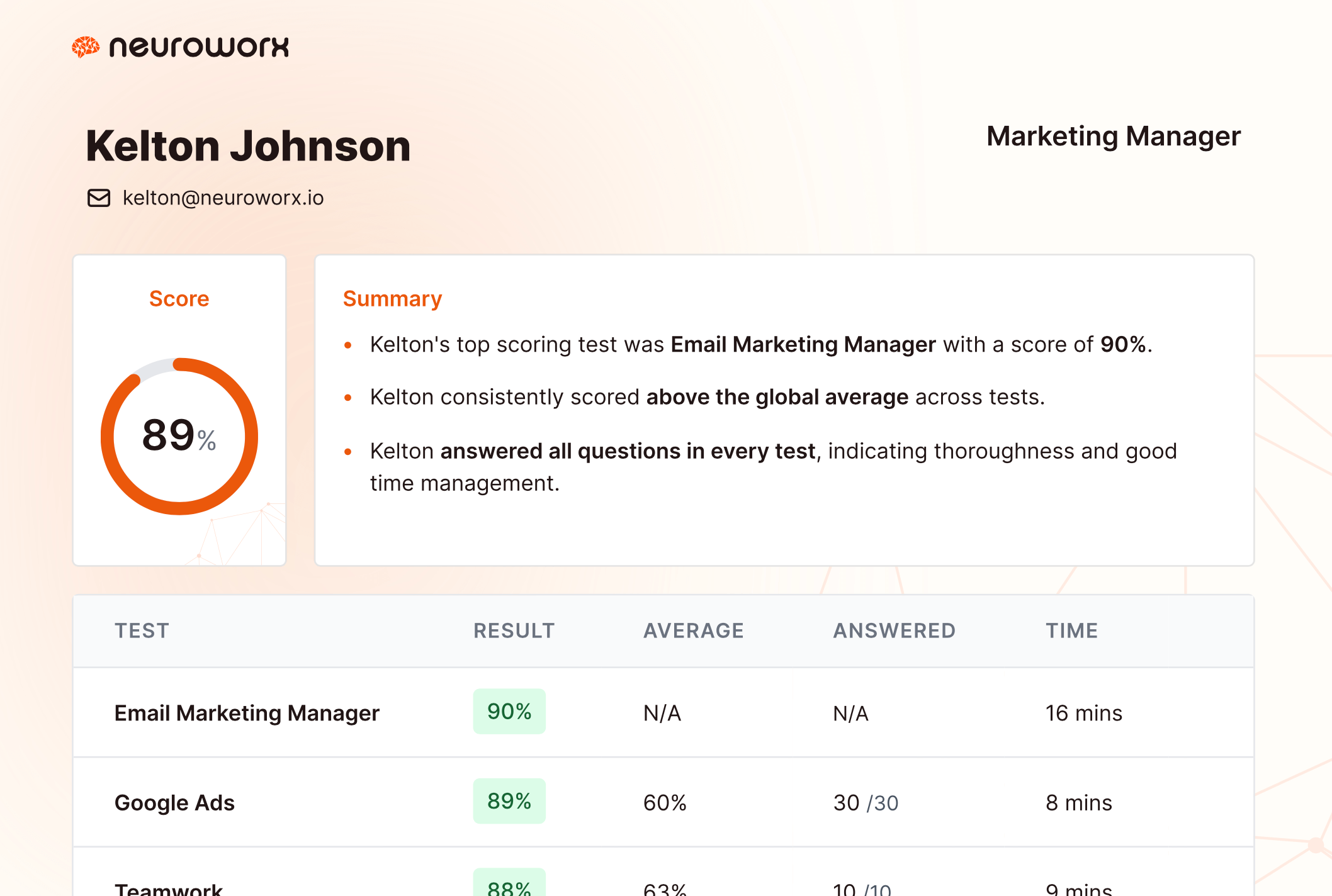

Results for the Credit Analyst Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

Candidates will need to answer a range of questions that measure industry-specific technical skills where applicable (e.g. Microsoft Excel), soft skills (e.g. decision making), aptitude (e.g. error checking) and relevant personality dimensions (e.g. detail orientation). The results present a holistic view of how well-suited each candidate is for the job at hand, using a data-driven approach.

The format varies by type of question, including multiple-choice for aptitude and technical skills, situational judgement for soft skills and agreement on a Likert scale for the personality dimensions. This approach ensures candidates are being assessed in an accurate and fair manner, and that results reflect the true underlying qualities of each candidate.

The characteristics, abilities and knowledge necessary to be a credit analyst were identified using the US Department of Labor's comprehensive O*NET database. O*NET is the leading source of occupational information that is constantly updated by collecting data from employees in specific job roles.

During the development process, test questions were rigorously analyzed to maximize reliability and validity in line with industry best practices. They were created by our team of I/O psychologists and psychometricians – who collaborated with subject-matter-experts – and field-tested with a representative sample of job applicants who have varying experience, just like you might find in a talent pool.

Each test is reviewed by a panel of individuals representing diverse backgrounds to check for any sensitivity, fairness, face validity and accessibility issues. This ensures each candidate has a fair chance of demonstrating their true level of expertise.

Our credit analyst test is monitored to ensure it is up-to-date and optimized for performance.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

The skills needed to be an effective credit analyst include numerical skills, logical reasoning, analytical skills, attention to detail and strong interpersonal skills. The ability to manage their time and prioritize tasks is also a skill essential to a credit analyst.

Credit analysts work with various software depending on their organization's systems. Working knowledge of Microsoft Excel is essential to the role of a credit analyst. Other types of software may include Tableau or Power BI.

Neuroworx operates on a monthly or annual subscription basis. We have several plans to suit your hiring needs, which you can check out here. Alternatively, you can get in touch with us to discuss a custom plan.

Yes, simply sign up (no credit card is required) and we'll give you unlimited access for seven days. Create as many jobs and test as many candidates as you want; you won't be charged a penny.

A medical transcriptionist test helps prospective employers identify which candidates have the necessary skills and competencies to be an effective medical transcriptionist.

Assess Sales Director candidates' strategic and managerial prowess with our scenario-based test.

A Java developer is a person who works in the Java coding language. This type of programming language has been in use for more than 20 years, and the Java developer job knowledge test is an effective way to find the right candidate for the job.

An enrolled agent is an important addition to a business to ensure that tax returns are completed fully and on time, with expert knowledge on deductions and exceptions in line with IRS rules and regulations.

Talk is cheap. We offer a 7-day free trial so you can see our platform for yourselves.

Try for free